Saving for a down payment is the biggest challenge for many Canadians. A NerdWallet survey found that 5.9 million Canadians planning to buy a home within five years can’t afford the $20,000 down payment on a $400,000 house. Rising prices are making it even harder for first-time buyers to save.

Budget 2024 offers relief by increasing the Home Buyers’ Plan (HBP) withdrawal limit from $35,000 to $60,000, allowing buyers to leverage more of their RRSP savings. New rules also reduce down payment requirements for homes over $1 million, easing access to the market.

In this article, we’ll explore five budgeting tips for first-time buyers in Burlington, helping you plan financially, manage extra costs, and use available incentives. Let’s dive in!

What Experts Say: Budgeting Tips for First-Time Homebuyers in Burlington

Buying a home requires more than just saving for a down payment—it’s about building a smart financial plan that considers all the costs. Experts recommend focusing on what you can afford, planning for unexpected expenses, and leveraging incentives like the Home Buyers’ Plan.

1. Determine What You Can Afford

When buying a home in Canada, down payment requirements vary depending on the property’s price.

- Under $500,000: Minimum 5% down payment of the purchase price.

- Between $500,000 and $1 million: 5% on the first $500,000, plus 10% on any amount above that.

- Over $1 million: A 20% down payment is required—however, after December 15, 2024, this threshold increases to $1.5 million, making it easier for buyers to qualify for higher-priced homes.

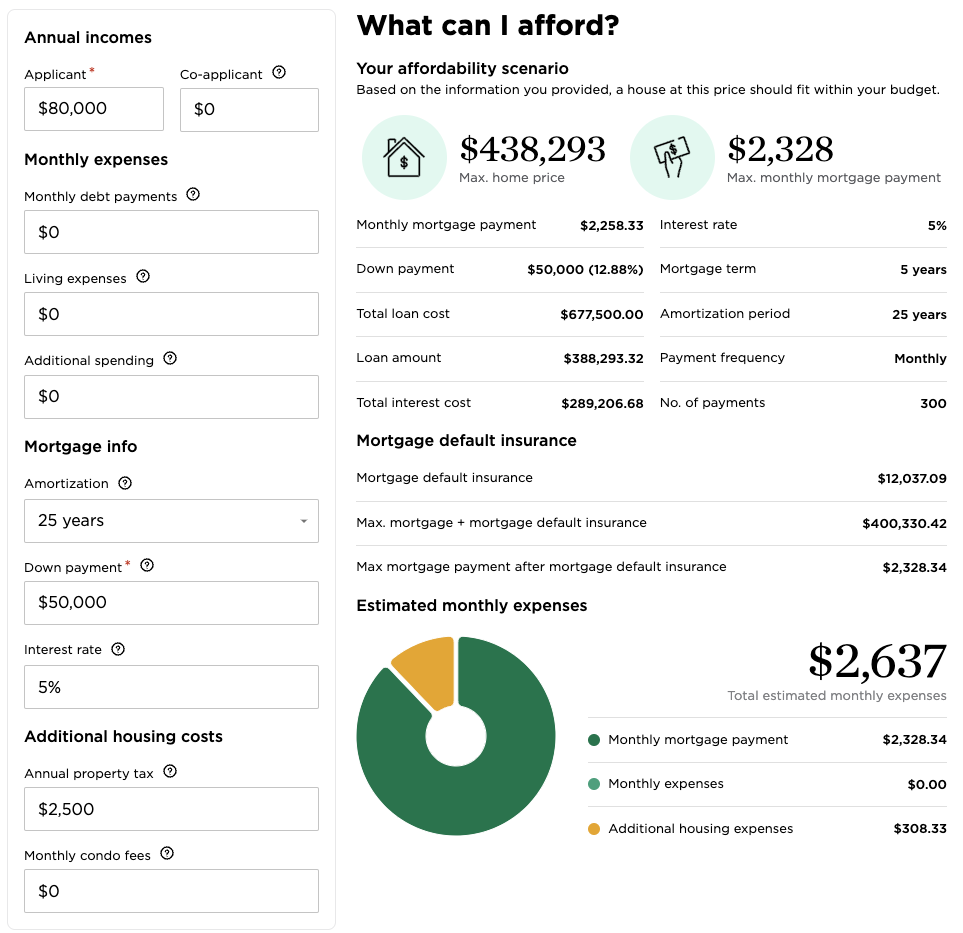

Using a mortgage affordability calculator can help you estimate how much you can borrow by considering your income, existing debt, and monthly expenses.

It’s also smart to get pre-approved for a mortgage before house hunting. Pre-approval not only gives you a clear budget but also positions you as a serious buyer, which can be an advantage during negotiations.

By understanding down payment rules and planning your budget accordingly, you’ll be well-prepared to enter the Burlington market with confidence.

2. Save Strategically for Your Down Payment

Building a down payment fund takes planning, consistency, and smart money habits. Here are practical ways to reach your savings goal faster:

Set a Realistic Savings Goal

As previously mentioned, use a mortgage calculator to determine your ideal down payment amount based on the home price range you’re targeting. This helps you plan for the required 5% to 20% down payment depending on the property value.

For example, if you need $30,000 in 3 years, you’ll need to save $833/month—seeing smaller targets makes it less overwhelming.

Automate Your Savings

Set up automatic transfers from your main account to a dedicated savings account, aligning with your payday to build the habit seamlessly. Automating contributions—whether weekly, biweekly, or monthly—ensures consistency and reduces the temptation to spend that money elsewhere. Over time, even small, regular transfers add up and bring you closer to your goal.

Apps like Wealthsimple or Questrade offer automated investment options so you can grow your savings through low-risk portfolios.

Use Windfalls Wisely

Direct unexpected cash—like bonuses, tax refunds, or gifts—into your down payment savings. These lump sums can shorten your savings timeline.

Reduce Expenses with a Budget Plan

Review your monthly spending and cut non-essential expenses (like subscriptions or dining out) to free up money for savings. Even $200/month can make a big difference over time.

Use the 50/30/20 budgeting rule. Allocate 50% of your income for needs, 30% for wants, and 20% for savings.

Open a Tax-Free First Home Savings Account (FHSA)

Take advantage of government programs like the First Home Savings Account (FHSA) to save tax-free. Contributions to your FHSA can complement withdrawals from your RRSP via the Home Buyers’ Plan, giving you a significant savings boost.

By automating savings, using windfalls strategically, and optimizing government programs, you’ll stay on track and reach your down payment goal more efficiently.

3. Account for Additional Homeownership Costs

Owning a home is more than just making mortgage payments—it comes with several recurring and one-time expenses that can catch buyers off guard. Planning ahead for these costs will help you stay financially secure after the purchase.

Beyond the Mortgage: Recurring Costs

- Property Taxes: These vary by municipality, so it’s essential to check Burlington’s current rates to factor them into your budget.

- Homeowners Insurance: A must-have to protect your investment, with premiums based on the property’s value, location, and coverage level.

- Utilities and Maintenance: Heating, electricity, water, and regular upkeep (like lawn care or gutter cleaning) can quickly add hundreds of dollars to your monthly budget. The condition and size of the home will influence these costs significantly.

- Repairs and Emergencies: Unexpected repairs, such as fixing a roof leak or replacing appliances, are inevitable. Setting aside 1-3% of the home’s value annually for repairs is a good rule of thumb.

One-Time Costs: Upfront Expenses to Budget For

- Home Inspection: Hiring a professional to inspect the property can cost $300-$600 but provides peace of mind by identifying potential issues before closing.

- Legal and Closing Fees: Lawyer fees and other closing costs—like title insurance or land transfer taxes—can add another 1-4% of the purchase price. Be sure to get an estimate from your lawyer to avoid surprises on closing day.

Managing these expenses doesn’t have to feel overwhelming. Cruz Financial Group can help you navigate your budget, providing expert guidance on affordable mortgage options and ensuring you’re fully prepared for both the known and hidden costs of homeownership.

4. Improve Your Credit Score Before Applying for a Mortgage

A higher credit score isn’t just a number—it can unlock lower mortgage rates and better loan terms, potentially saving you thousands over the life of your mortgage. Lenders use your credit score to assess your reliability, so taking steps to improve it before applying for a mortgage gives you a financial edge.

Steps to Improve Your Credit:

- Pay bills on time: Late payments can negatively affect your score, so set reminders or automate payments.

- Reduce outstanding debt: Aim to keep your credit utilization ratio under 30%, meaning you use no more than 30% of your available credit.

- Check your credit report for errors: Review your credit report regularly through services like Equifax or TransUnion Canada to ensure it’s accurate and dispute any errors promptly.

- Avoid new credit inquiries: Too many hard inquiries can lower your score, so limit new credit applications in the months leading up to your mortgage application.

5. Consider Assistance Programs and Tax Credits

First-time homebuyers in Canada have access to federal programs and tax incentives designed to make homeownership more affordable. Taking advantage of these opportunities can help reduce your financial burden and accelerate your journey to owning a home.

First-Time Home Buyer Incentives

- First-Time Home Buyer Incentive (FTHBI): This federal program offers a shared-equity loan, where the government provides 5% or 10% of your home’s value to lower your mortgage payments without interest. Eligibility depends on your income and the property price.

- Local and Provincial Grants: Ontario sometimes provides down payment assistance grants or forgivable loans—especially for moderate-income families. It’s worth researching Burlington-specific programs that could provide direct financial support.

Tax Benefits for First-Time Buyers

- Home Buyers’ Plan (HBP): This program allows you to withdraw up to $35,000 tax-free from your RRSP to put toward a down payment. The HBP has been further expanded, allowing first-time buyers to withdraw up to $60,000 starting in 2024, helping buyers save even more through retirement contributions.

- First-Time Home Buyers’ Tax Credit (HBTC): As of 2022, eligible buyers can claim a $10,000 non-refundable tax credit, providing up to $1,500 in tax relief to cover closing costs and other expenses.

Closing

Buying a home is an exciting milestone, but first-time homebuyers in Burlington need a solid financial plan to make the journey smoother. By following these budgeting strategies—understanding what you can afford, saving effectively, managing hidden costs, boosting your credit, and using assistance programs—you’ll be better prepared to navigate the process with confidence.

Key Takeaways:

- Know What You Can Afford: Use mortgage calculators and get pre-approved to set realistic expectations and strengthen your negotiating power.

- Save Smarter, Not Harder: Automate savings and explore tax-free accounts like the FHSA or the expanded RRSP Home Buyers’ Plan for a down payment boost.

- Plan Beyond the Mortgage: Prepare for property taxes, maintenance, and legal fees to avoid surprises after closing and keep your finances in check.

Ready to take the next step toward homeownership? Cruz Financial is here to help with personalized mortgage advice, budgeting strategies, and guidance on available incentives. Reach out today and let our experts walk you through the process—so you can buy your first home with confidence and ease.