Thinking of buying your first home in Burlington? In 2024, the market is competitive, with a median home price of $269,900—still lower than the state median, but homes are selling fast, typically in 23 days. For first-time buyers, that means acting quickly and being prepared.

While housing supply is up 40% from last year, Burlington is still a seller’s market. With mortgage rates at 6.6%, the average monthly payment is $1,808, offering some breathing room compared to 2023.

In this guide, we’ll walk you through key steps to successfully navigate Burlington’s real estate market—from mortgage pre-approval to finding the right experts. Let’s make your first home-buying experience as smooth as possible!

Understanding Mortgage Pre-Approval

Mortgage pre-approval is one of the most crucial steps in the home-buying process, especially for first-time buyers in Burlington. It gives you a clear idea of how much you can afford, so you can narrow down your home search and avoid falling in love with properties outside your budget. Plus, it shows sellers you’re a serious buyer, which can be a big advantage in a competitive market like Burlington.

How Pre-Approval Impacts Your Home Search

Once you’re pre-approved, you’ll be able to confidently search for homes within your price range. This speeds up the buying process and can give you leverage in negotiations. In Burlington’s fast-paced market, where homes sell in about 23 days, having pre-approval can mean the difference between securing your dream home or missing out.

Want to dive deeper into mortgage pre-approval? Check out this post for everything you need to know about getting pre-approved in Canada and how it can give you a competitive edge!

Financial Assistance Programs for First-Time Homebuyers in Burlington

Buying your first home can feel overwhelming, but there are several federal and provincial programs designed to ease the financial burden. Here’s a breakdown of some key incentives available to first-time homebuyers in Canada:

1. Home Buyers’ Plan (HBP)

This federal program allows you to withdraw up to $35,000 from your RRSP (Registered Retirement Savings Plan) to use toward your down payment. The best part? You won’t be taxed on the withdrawal as long as you repay it within 15 years. It’s a great option for buyers looking to boost their down payment.

You can learn more about the eligibility criteria here.

2. First-Time Home Buyers’ Tax Credit (HBTC)

The First-Time Home Buyers’ Tax Credit is currently a $5,000 non-refundable tax credit that can reduce your tax bill by up to $750. However, recent proposals aim to double the amount to $10,000, which would increase the tax credit to a maximum of $1,500 for eligible buyers. This enhanced tax break can provide much-needed relief after your home purchase, helping you manage costs during the critical first year of ownership.

3. First Home Savings Account (FHSA)

The First Home Savings Account (FHSA) lets you save up to $40,000 tax-free toward your first home. Contributions to the account are tax-deductible, and any withdrawals made for the purpose of buying a home are also tax-free. This new tool is designed to help first-time buyers save faster while enjoying tax advantages, making it an excellent option for those planning ahead.

With the FHSA, you can combine benefits from both the Home Buyers’ Plan (HBP) and this account to boost your down payment and lower your financial strain.

Saving for a Down Payment

Saving for a down payment can feel like a daunting task, but with the right strategies, it’s achievable. From smart budgeting to leveraging assistance programs, there are plenty of ways to speed up the process and get closer to your homeownership goals. Let’s explore some practical tips to help you save effectively.

Smart Budgeting for Your Down Payment

Saving for a down payment is one of the biggest hurdles for first-time homebuyers, but it doesn’t have to be overwhelming.

- Start by creating a realistic budget that outlines your income, expenses, and savings goals.

- Cutting non-essential spending—like dining out or subscription services—can free up extra cash each month.

- Setting up automatic transfers to a dedicated savings account can also help you stay consistent without even thinking about it.

Use Down Payment Assistance Programs

Don’t forget to explore available assistance options. Programs like the First Home Savings Account (FHSA) and the Home Buyers’ Plan (HBP) allow you to save and withdraw money tax-free, giving your down payment savings a much-needed boost. These programs can help you reach your goal faster, while still keeping your overall budget manageable.

Break It Down Into Manageable Steps

It’s easy to get discouraged when aiming for a large down payment, but breaking it down into smaller, achievable goals can keep you motivated. Set monthly or quarterly targets, and celebrate small wins along the way. You can also consider side gigs or part-time work to supplement your income and speed up your savings. Remember, every little bit adds up!

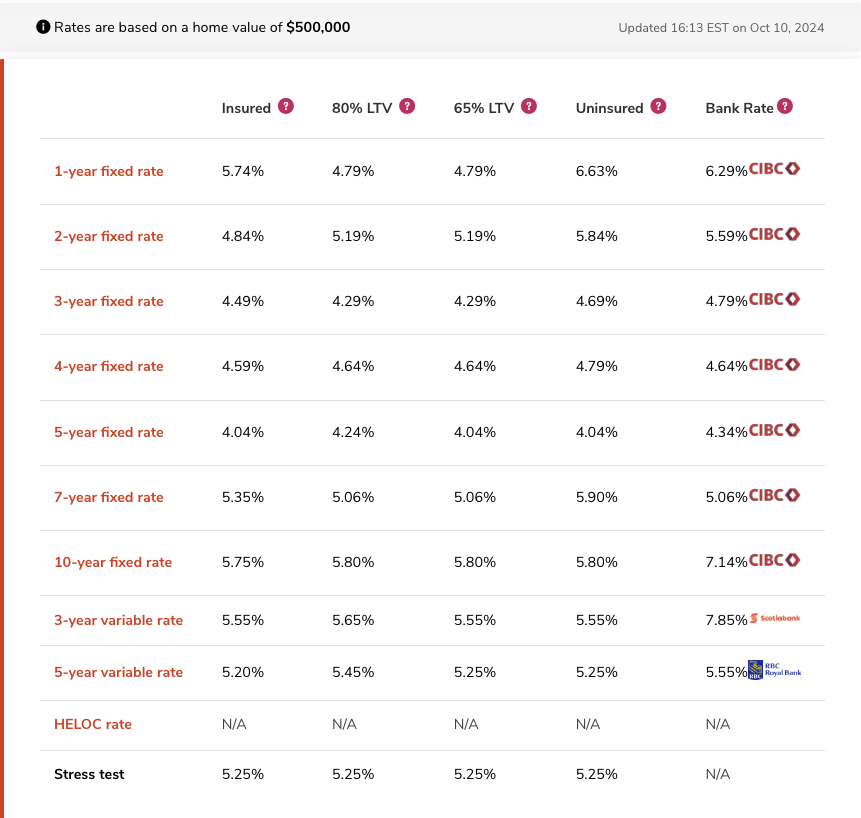

Fixed vs. Variable Rates: What’s the Difference?

One of the biggest decisions first-time buyers face is choosing between a fixed or variable mortgage rate. A fixed rate locks in your interest rate for the term of your mortgage, offering stability and predictable payments—a great option if you prefer to budget with certainty. On the other hand, variable rates fluctuate with market changes. While they can offer lower rates initially, there’s more risk if interest rates rise.

In Burlington, where the market remains competitive, deciding between these options depends on your financial comfort level and long-term goals.

Finding the Best Terms for First-Time Buyers

For first-time homebuyers, it’s crucial to weigh your options carefully. Fixed rates provide peace of mind, especially in uncertain markets, but variable rates might help you save more if you’re able to tolerate some risk.

Need expert guidance? Cruz Financial specializes in finding the best mortgage rates tailored to your needs. Their team can walk you through both options, helping you decide which rate—and term—makes the most sense for your situation. Plus, they’ll handle everything from application to closing, making your home-buying process stress-free and efficient!

First-time Homebuyers in Burlington: Why You Need Experts on Your Side

Buying your first home is a big financial commitment, and having the right experts in your corner can make all the difference. Financial advisors, real estate agents, and home inspectors provide valuable insights that can help you avoid costly mistakes and make informed decisions.

A financial advisor, like the team at Cruz Financial, can help you understand your mortgage options, create a budget, and maximize the financial assistance programs available to you.

- Expert Negotiation Skills: Professionals like real estate agents can secure the best price and terms, making sure you don’t overpay in a competitive market.

- Access to Market Knowledge: Financial advisors and agents understand local market trends, mortgage rates, and housing inventory, helping you make well-informed decisions.

- Streamlined Process: From mortgage pre-approval to closing, experts handle the paperwork and guide you step-by-step, ensuring everything runs smoothly and on time.

- Avoid Costly Mistakes: Home inspectors and advisors catch red flags early, helping you avoid unexpected repair bills or unfavorable mortgage terms down the line.

- Peace of Mind: Having a trusted team means you’ll have confidence at every stage, from financing to choosing the right home, so you can focus on the excitement of becoming a homeowner!

Conclusion

Buying your first home is a big step, but with the right information and expert guidance, it can be a smooth and rewarding experience. Make sure to do your research, explore all financial assistance options, and lean on professionals to help you navigate the process confidently.

Key Takeaways:

- Get pre-approved for a mortgage to streamline your home search.

- Take advantage of federal and provincial programs to reduce upfront costs.

- Work with trusted experts to avoid costly mistakes and make informed decisions.

Ready to take the next step in your home-buying journey? Let Cruz Financial find the best mortgage rates and guide you from start to finish. Contact them today for personalized, expert advice!