Ready to buy your dream home but wondering how to make it more affordable? With recent data from Ratehub.ca showing that qualifying for a mortgage in major Canadian cities became slightly easier in July 2024, now is a great time to boost your borrowing potential. In our last blog, we covered the basics of mortgage affordability and understanding the key factors in determining how much mortgage you can afford.

Today, we’re taking it a step further. We’ll share practical tips you can use to improve your mortgage affordability, so you can secure better terms and buy the home you want. You’ll discover how to calculate affordability, increase your down payment, and more!

How to Calculate Your Mortgage Affordability in Canada

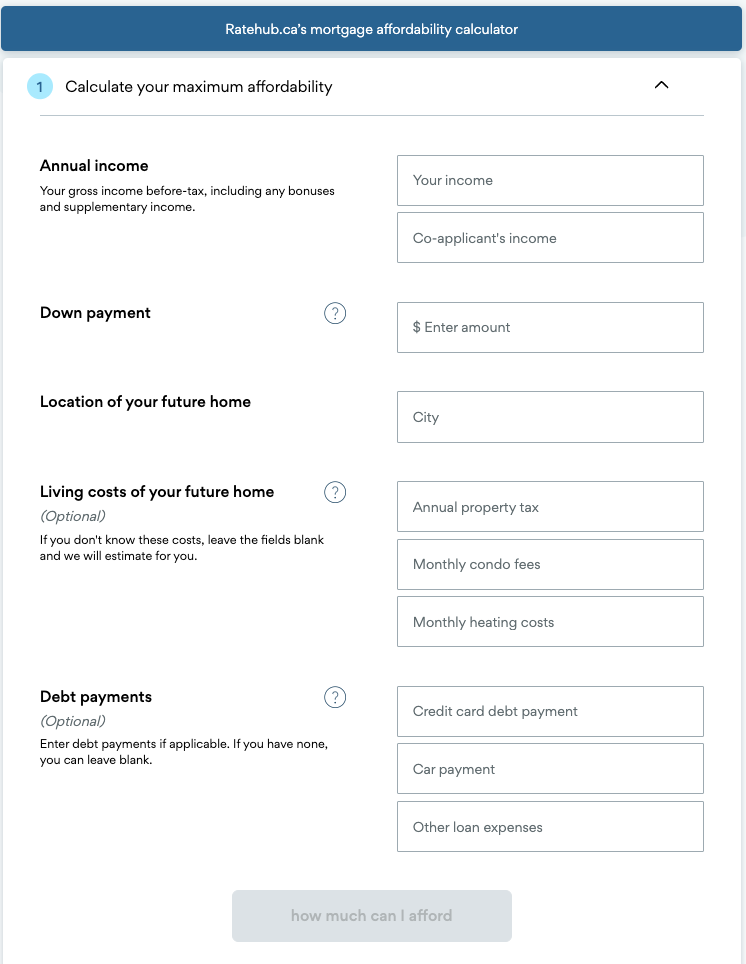

Before diving into mortgage options, it’s crucial to know how much you can truly afford. A mortgage affordability calculator is a valuable tool that helps estimate the home price you can manage, factoring in your income, debts, and interest rates.

Use a Mortgage Affordability Calculator

Calculating your mortgage affordability involves understanding several key financial elements. A mortgage affordability calculator helps you gauge what home price you can realistically afford by assessing the following:

- Gross income

- Current debts

- Monthly expenses

- Interest rates

By taking into account these factors, it will give you a realistic idea of the home value within your budget. For example, the Ratehub.ca Mortgage Affordability Calculator even includes living costs of your future home to avoid surprises later on.

Inputting these figures gives you a breakdown of your maximum loan amount and monthly mortgage payment. When using a mortgage calculator, it’s essential to include all sources of income and ensure you’re inputting accurate debt figures to get a clear picture of your borrowing power.

Keep in mind that affordability calculators generally factor in two important ratios:

- Gross Debt Service Ratio (GDS): Ensures your housing costs (mortgage payments, property taxes, heating costs) don’t exceed 32% of your gross income.

- Total Debt Service Ratio (TDS): Ensures total debts (including credit cards, car loans) don’t exceed 40-44% of your income.

These ratios are crucial in determining not just how much you can borrow, but how comfortably you can manage those payments.

Example Mortgage Affordability Calculation

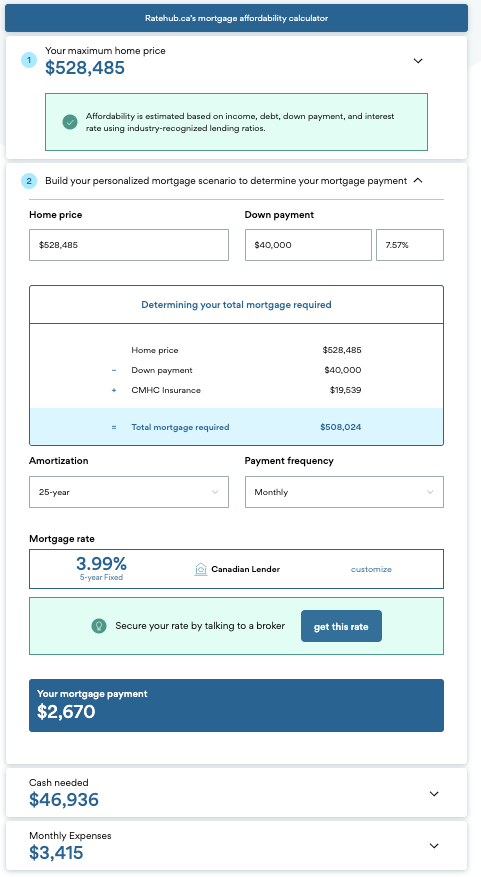

Let’s dive into a specific scenario to see how affordability works in real life. Take a couple earning a combined $120,000 annually, with minimal debts and a $40,000 down payment. Based on current interest rates, they could potentially afford a home priced at around $528,485.

Here’s how it works:

- Income: Their gross income of $120,000 gives them flexibility in affording higher monthly payments.

- Debts: With minimal debts, their Total Debt Service Ratio (TDS) remains low, improving their eligibility.

- Down Payment: A $40,000 down payment reduces the amount they need to borrow, increasing their affordability. A higher down payment also helps them avoid mortgage insurance fees like CMHC insurance, which can further reduce monthly costs.

Plugging these numbers into a calculator will show how income, debt, and down payment can change what you afford. You’ll also get an idea of additional costs like closing fees, property taxes, and insurance.

By using these tools and applying real-world numbers, you’ll have a clearer sense of the mortgage you can handle, ensuring you’re financially prepared to buy a home within your means.

If you’re ready to improve your mortgage affordability and navigate the home-buying process with confidence, Cruz Financial Group can help. Whether you need assistance calculating your mortgage potential or advice on securing the best terms, their mortgage consulting services are designed to guide you through every step.

How to Improve Your Mortgage Affordability

Improving your mortgage affordability can open doors to better rates and higher borrowing power. From increasing your down payment to reducing your debt, there are actionable steps you can take to make your home-buying process smoother. In this section, we’ll break down practical strategies to help you qualify for a larger mortgage and reduce your monthly payments.

Increase Your Down Payment

Boosting your down payment lowers your Loan-to-Value (LTV) ratio, which can result in better mortgage rates and increase your borrowing power. By reducing how much you need to borrow, you not only decrease monthly payments but may also avoid CMHC insurance, further saving you money in the long run.

Aim to save at least 20% for your down payment. This reduces your Loan-to-Value (LTV) ratio and can help you avoid CMHC insurance premiums. Consider setting up automated savings or using windfalls like tax refunds or bonuses to boost your down payment faster.

Reduce Debt

Lowering existing debt improves your Total Debt Service (TDS) ratio, making lenders more comfortable offering you better rates. Focus on paying down high-interest debt like credit cards or car loans. If managing multiple debts, debt consolidation loans can simplify payments and lower interest, freeing up cash to boost your mortgage application.

Improve Credit Score

A higher credit score can secure you a lower interest rate, directly impacting the affordability of your mortgage. Even a small boost in your score can save you thousands over the life of the loan. Here are some actionable tips to improve your credit score:

- Pay Bills on Time: Timely payments are one of the biggest factors in maintaining a healthy credit score. Set up reminders or automatic payments to avoid missing due dates.

- Reduce Credit Utilization: Aim to use less than 30% of your available credit limit. This shows lenders you manage credit responsibly.

- Avoid New Debt: Hold off on applying for new credit cards or loans, as this can lower your score and signal higher risk to lenders.

- Check Your Credit Report: Regularly review your credit report for errors or inaccuracies and dispute them to ensure your score is accurate.

- Pay Down Existing Debt: Focus on reducing outstanding balances on credit cards or loans to show lenders you’re managing debt well.

4. Choose a Longer Amortization Period

Opting for a 30-year mortgage instead of the standard 25-year term can reduce monthly payments, making your mortgage more affordable in the short term. However, this comes at the cost of paying more interest over the life of the loan. It’s important to weigh the short-term relief against the long-term expense.

5. Consider a Co-Borrower

Adding a co-borrower (like a partner or family member) can increase your overall borrowing power. Their income and credit history are factored in, allowing you to qualify for a larger mortgage. Just keep in mind that this person will share the responsibility for repaying the loan.

Conclusion

Boosting your mortgage affordability requires a mix of smart financial strategies like increasing your down payment, reducing debt, and improving your credit score. Simple actions like consolidating debt, choosing a longer amortization period, or adding a co-borrower can significantly improve your borrowing power.

Ready to take the next step toward homeownership? Cruz Financial Group is here to simplify the mortgage process and help you secure the best rates. Get personalized advice tailored to your financial needs and start planning for your dream home today. Schedule a consultation now!