Thinking about buying a home in Burlington? You’re in good company—Burlington’s real estate market is booming, with home prices now surpassing $1 million in the Greater Toronto Hamilton Area (GTHA). New data from Burlington Today highlights a sharp rise in property values, driven by high demand and limited supply.

But the initial price tag isn’t the whole story. Many first-time buyers are surprised by the hidden costs of homeownership—expenses like unexpected repairs and rising property taxes. These additional costs can quickly strain your budget if you’re not prepared.

In this article, we’ll uncover the true costs of buying a home in Burlington. You’ll learn about the common pitfalls and how to budget wisely, so you can make informed decisions and avoid surprises down the road.

Understanding the True Cost of Homeownership

When buying a home, it’s easy to focus solely on the mortgage—after all, it’s the biggest expense on paper. However, many first-time buyers overlook the hidden costs of homeownership that can significantly impact their finances. These hidden costs go beyond your monthly mortgage payment and include expenses like property taxes, insurance, maintenance, and unexpected repairs.

Visible Costs vs. Hidden Costs:

- Visible Costs: These are the predictable expenses you plan for, such as the down payment, mortgage payments, and closing costs.

- Hidden Costs: These include ongoing expenses like property taxes, utility bills, homeowners insurance, and home repairs. They’re often unexpected but can add up quickly.

Why does this matter? If you don’t budget for these additional costs, they can catch you off guard, leading to financial stress and even jeopardizing your investment. Proper budgeting means accounting for these unseen expenses right from the start, giving you a realistic picture of what it truly takes to own a home.

Common Hidden Costs of Homeownership in Burlington

When purchasing a home in Burlington, it’s essential to consider expenses beyond the mortgage. These hidden costs can significantly impact your budget.

Property Taxes

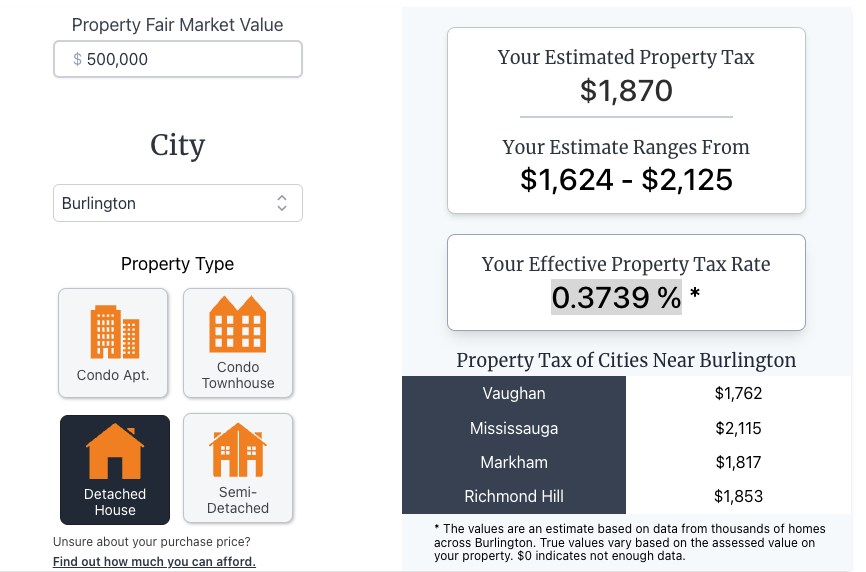

Burlington’s property tax rates are determined annually and vary based on property assessments. For example, the property taxes for a $500,000 home is approximately $1,870 with an effective property tax rate of around 0.3739 %.

Factors influencing property tax amounts include property location, size, and assessed value. It’s crucial to review the latest rates and understand how assessments affect your tax obligations.

Homeowners Insurance

In Burlington, the average cost of homeowners insurance is approximately $1,500 per year for a dwelling coverage of $300,000.

Standard policies cover events like fire and theft, but additional coverage for floods or earthquakes may be necessary, depending on the property’s location and risk factors. Consulting with an insurance agent can help tailor a policy to your specific needs.

Maintenance and Repairs

Regular maintenance tasks such as lawn care, HVAC servicing, and gutter cleaning are essential to prevent costly repairs. Homeowners should budget approximately 1% of the home’s purchase price annually for maintenance. For a $500,000 home, this equates to $5,000 per year. Neglecting routine upkeep can lead to significant expenses down the line.

Utilities

Typical utility bills for homeowners in Burlington, including electricity, water, and heating, average around $103 to $200 per month. Seasonal variations, such as increased heating costs in winter, can affect these expenses. Implementing energy-efficient appliances and practices can help manage and reduce utility bills over time.

Homeowners Association (HOA) Fees

In certain Burlington neighborhoods, homeowners are subject to HOA fees, which can range from $50 to $500 monthly. These fees typically cover services like landscaping, snow removal, and maintenance of common areas. It’s important to review HOA covenants and understand the services provided to assess the value and necessity of these fees.

By accounting for these hidden costs, prospective homeowners can create a comprehensive budget and avoid unexpected financial challenges.

Additional Expenses to Consider

Aside from property taxes and insurance, homebuyers in Burlington should plan for several other unexpected expenses. These additional costs can make a significant difference in your overall budget and are often overlooked by first-time buyers.

Closing Costs

Closing costs in Burlington typically range from 1.5% to 4% of the home’s purchase price. For a $750,000 home, this could mean $11,250 to $30,000. Common expenses include legal fees, land transfer tax, title insurance, and appraisal fees.

Tips to Reduce Closing Costs:

- Shop Around for Legal Services: Different law firms have varying fee structures; compare rates to find a more affordable option.

- Negotiate with the Seller: Request that the seller covers a portion of the closing costs, especially in a buyer’s market.

- Look for First-Time Buyer Incentives: Take advantage of Ontario’s land transfer tax rebate for first-time buyers, which can save up to $4,000.

Looking for Guidance? Cruz Financial Group can help you navigate these unexpected expenses and offer personalized financial advice tailored to your homeownership goals.

Appliances and Furnishings

Outfitting a new home can be costly, especially if you need to purchase major appliances like a refrigerator, stove, washer, and dryer. Basic kitchen appliances alone can total $5,000 or more. Furniture costs depend on your style and needs but could easily add another $10,000 for essentials.

Budget Tip: Prioritize essential items first and gradually add optional pieces to avoid overspending.

Landscaping and Outdoor Maintenance

Maintaining the exterior of your home is another ongoing expense. Lawn care services in Burlington typically range from $50 to $100 per month, while snow removal can cost $300 to $500 per season. Additionally, larger projects like tree trimming or garden redesigns can add up.

Seasonal Considerations: Plan for higher costs in winter (snow removal) and spring (lawn care and gardening). Hiring local service providers for bundled seasonal packages can help reduce overall costs.

Smart Financial Planning for First-Time Homeowners

Preparing for the financial realities of homeownership is more than just securing a mortgage—it’s about understanding the full scope of ongoing expenses. Here’s how to get started on the right foot:

- Seek Expert Financial Advice: Don’t underestimate the value of meeting with a financial advisor early. They can help you create a comprehensive home-buying budget, identify potential pitfalls, and offer personalized strategies to align your goals with your financial situation.

- Leverage Budgeting Apps and Tools: Use digital tools like Mint, YNAB (You Need a Budget), or detailed Excel templates to track every expense. These tools give you a clear picture of your financial commitments, helping you stay on top of recurring costs and unexpected surprises.

- Know Your Mortgage Options Inside Out: The type of mortgage you choose—fixed-rate, variable-rate, or hybrid—impacts your financial stability. Fixed-rate mortgages offer predictability, while variable-rate mortgages can start lower but carry the risk of fluctuating payments. Understand these differences to make an informed choice.

- Establish an Emergency Fund Early: Set aside at least 3-6 months’ worth of living expenses in an emergency fund. This safety net is crucial for covering sudden expenses like a broken furnace or a leaky roof, helping you avoid dipping into savings or taking on debt.

- Budgeting for Home Maintenance: Budget 1% to 2% of your home’s value annually for upkeep. Regular maintenance, like HVAC checks and roof inspections, prevents minor issues from escalating into costly repairs.

- Tap Into Homebuyer Incentives: Don’t leave money on the table! Explore Ontario’s First-Time Home Buyer Incentive and the Land Transfer Tax Rebate. These programs can significantly reduce your upfront costs, easing the financial burden of buying your first home.

- Calculate Your True Cost of Homeownership: Go beyond the mortgage payment when budgeting. Include property taxes, insurance, HOA fees, utilities, and regular maintenance to get a realistic view of your monthly expenses. This holistic approach helps you avoid unpleasant financial surprises down the road.

By following these practical steps, you’ll be well-prepared to take on the financial responsibilities of homeownership, ensuring a smoother transition and greater peace of mind.

Ready to Own Your Burlington Home Without Hidden Costs?

Buying a home in Burlington is an exciting step, but recognizing unexpected homeowner expenses is crucial for long-term financial success. Planning for expenses like property taxes, insurance, and unexpected repairs can help you avoid common pitfalls and enjoy your new home stress-free. With thorough research and smart budgeting, you’ll be well-prepared for the full financial commitment of homeownership.

At Cruz Financial Group, we specialize in mortgage pre-approval services, helping you understand your borrowing capacity and ensuring you’re well-informed about potential costs. Our team is dedicated to guiding you through the financial aspects of buying a home, so you can proceed with confidence and clarity.