While being your own boss offers incredible perks—autonomy, flexibility, and potentially higher income—until it’s time to apply for a mortgage. Suddenly, the perks of autonomy and potential for higher income feel overshadowed by the challenge of proving stable earnings. Sound familiar?

In 2023, over 2.6 million Canadians were self-employed, making up 13.2% of the workforce. Despite contributing to a wide range of industries, self-employed individuals often face extra hurdles when house hunting in Burlington. Traditional lenders may struggle to see beyond fluctuating income, creating roadblocks for many aspiring homeowners.

But don’t fret! In this guide, you’ll discover how to tackle these challenges, explore self-employed mortgage options, and get expert advice to make your dream home a reality. Let’s get started!

Understanding the Landscape of Mortgages in Burlington

Looking ahead to 2025, Burlington’s housing market continues to shine as one of Ontario’s most desirable areas. With average home prices expected to rise by 4.5% and sales projected to grow by 6%, the city is a hotspot for first-time buyers, families, and investors alike.

Burlington’s appeal lies in its strategic location between Toronto and Hamilton, excellent schools, and vibrant community atmosphere, making it a prime choice for those seeking both convenience and quality of life.

You can learn more about Burlington’s housing market in 2025 here.

Mortgage Trends for Self-Employed Buyers in Burlington

Navigating the mortgage landscape as a self-employed individual in Burlington doesn’t have to feel like an uphill battle. While traditional lenders often require proof of stable income—a challenge for those with variable earnings and tax write-offs—specialized mortgage products like stated-income mortgages are designed with self-employed buyers in mind.

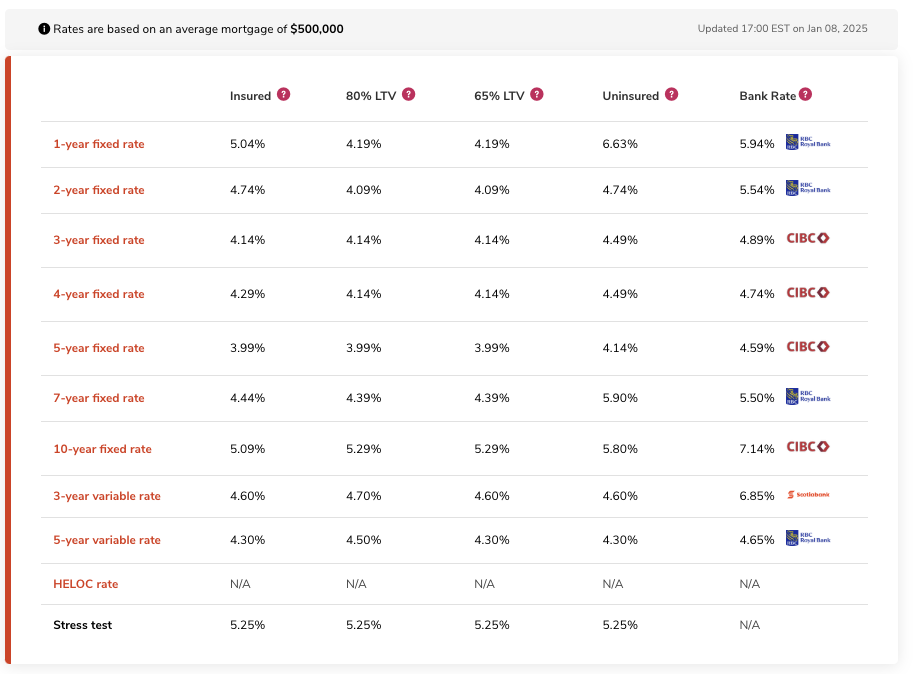

It’s worth noting that self-employed borrowers may face slightly higher interest rates than their traditionally employed counterparts. Rates can vary depending on the lender and financial profile, with private lenders typically offering 7–8% for first mortgages and 10–13% for second mortgages.

With the right broker by your side, you’ll have the tools to navigate these options and secure a mortgage that works for you.

What is a Self-Employed Mortgage?

A self-employed mortgage is tailored for those earning income through a business, freelancing, or gig work instead of a traditional salary. Unlike conventional mortgages, these loans require alternative ways to verify income, such as:

- Tax Filings: Line 150 of your income tax return.

- Supporting Documents: Notice of Assessment, business financials, or bank statements.

- Stated Income: Declaring income without full documentation, often used by private lenders.

While flexible, stated-income mortgages come with trade-offs—they’re considered higher-risk, requiring larger down payments (typically 35% or more) and higher interest rates. These specialized mortgages are designed to reflect the unique financial situations of self-employed individuals, offering solutions when traditional income verification methods fall short.

Income Challenges for the Self-Employed

Proving income stability is one of the biggest hurdles for self-employed borrowers. Unlike traditional employees with steady paychecks, self-employed individuals face unique challenges:

- Fluctuating Earnings: Seasonal work or inconsistent client payments can make income appear unreliable to lenders.

- Tax Write-Offs: While beneficial for reducing taxes, deductions can significantly lower taxable income, potentially making it seem insufficient for mortgage approval.

- Strict Income Verification: Banks often average net income over the past two years (Line 150 of tax filings) to determine eligibility, which may not reflect true earning potential.

To address these challenges, alternative lenders offer more flexible solutions:

- Gross-Up Options: Some lenders “gross up” net income by 15%, accounting for pre-deduction income.

- Expanded Income Consideration: Private lenders may include dividend income, commissions, or other revenue streams in their assessments.

- Tailored Evaluations: Alternative lenders focus on overall financial health, such as assets and credit scores, rather than just taxable income.

By leveraging these tailored options, self-employed individuals can secure a mortgage that aligns with their financial circumstances.

Why navigate these challenges alone when you can have a trusted ally by your side? Partnering with experts at Cruz Financial Group who are experienced in self-employed solutions is key to navigating these complexities.

Preparing for a Mortgage as a Self-Employed Individual

Applying for a mortgage as a self-employed individual can feel overwhelming, but with the right preparation, it’s entirely achievable. Lenders require specific documents, a solid credit score, and organized finances to assess your eligibility. Let’s break down the essentials to help you get mortgage-ready with confidence.

Documents You’ll Need to Secure a Mortgage

Getting approved for a mortgage as a self-employed individual requires thorough preparation. Lenders typically request:

- Last Two Years of Tax Documents: Full T1 Generals and associated Notices of Assessment.

- Business Registration: Articles of incorporation for incorporated businesses or HST registration for sole proprietors.

- Bank Statements: Six months of bank account activity to show consistent income and financial stability.

- Additional Proof: Customer invoices, deposit slips, and documentation of assets and liabilities.

Why Your Credit Score Matters More Than Ever

Your credit score plays a pivotal role in securing a mortgage, especially for self-employed borrowers. Banks often require a score of at least 620, while B lenders and private lenders may accept lower scores (as low as 500). A stronger score can help you access better interest rates and terms. To improve your score:

- Pay bills on time.

- Keep credit utilization under 30%.

- Check your credit report regularly for errors.

Financial Organization Tips for Self-Employed Buyers

Staying organized can streamline your mortgage application:

- Keep tax filings and financial statements updated and accessible.

- Maintain a dedicated business account to separate personal and professional expenses.

- Work with an accountant to maximize deductions without impacting reported income.

By preparing these documents, improving your credit score, and keeping your finances in order, you’ll be ready to navigate the mortgage process confidently as a self-employed buyer in Burlington.

Financial Strategies for Self-Employed Buyers

Saving for a down payment can feel daunting, but it’s crucial for self-employed buyers who often face higher requirements. While traditional borrowers may qualify with as little as 5% down, self-employed individuals often need 10–20%, or even 35% for stated-income mortgages.

Strategies to build your down payment include:

- Setting aside a fixed percentage of your monthly income in a high-yield savings account.

- Leveraging tax refunds or bonuses.

- Exploring government programs, such as the First-Time Home Buyer Incentive, for additional support.

Managing Income Fluctuations for Mortgage Approval

Income variability is one of the biggest challenges for self-employed buyers, but planning ahead can make a difference. Here’s how to manage it:

- Stabilize Your Income: Pay yourself a consistent salary from your business to show lenders steady earnings.

- Track Cash Flow: Maintain detailed records of income and expenses to demonstrate long-term financial stability.

- Build a Financial Cushion: Aim to save 3–6 months of living expenses to account for slower income periods.

Combining these strategies with professional financial advice can help self-employed buyers secure a mortgage that works for their unique situation while staying financially secure throughout the process.

Conclusion

Securing a mortgage when you’re self-employed doesn’t have to feel overwhelming. With proper preparation—gathering documents like T1 Generals and bank statements—and the right guidance, you’ll be ready to take the next step. A mortgage broker who understands self-employed buyers can make the process smoother, helping you find the perfect solution for your dream home.

Ready to make homeownership a reality? Contact Cruz Financial Group today for expert guidance tailored to your self-employed mortgage needs. Let’s find the solution that works for you!