Dreaming of owning a home in Burlington? With its top-rated schools, lush parks, and proximity to Toronto, it’s no wonder this city is a favorite for families and professionals. Burlington offers the perfect blend of suburban tranquility and urban convenience—an ideal place to put down roots.

However, homeownership here isn’t without its hurdles. High property values and rising living costs have left many Canadians waiting for interest rates to drop, according to a recent BMO survey. Even with potential rate cuts on the horizon, affordability challenges like inflation and unexpected expenses remain top concerns for homeowners.

This article will guide you through the financial planning essentials every Burlington homeowner needs. From managing debt to budgeting for repairs, you’ll learn practical strategies to take control of your finances and thrive in this sought-after community.

5 Financial Planning Tips for Homeowners

1. Assessing Your Current Financial Position

Understanding your financial position is the foundation of smart homeownership, especially in a high-demand market like Burlington. With property taxes, utility costs, and mortgage payments adding up quickly, it’s crucial to have a clear view of your income and expenses.

Evaluating Income and Expenses

Start by tracking your income and monthly spending using tools like the CRA-approved expense tracker or budgeting apps such as Mint or YNAB. These platforms simplify categorizing expenses and ensure your budget aligns with Canadian tax regulations.

For Burlington homeowners, be sure to factor in local costs like property taxes, which range from 0.78% to 1% depending on your home’s value, and higher-than-average utility bills during Ontario’s colder months.

Calculating Net Worth

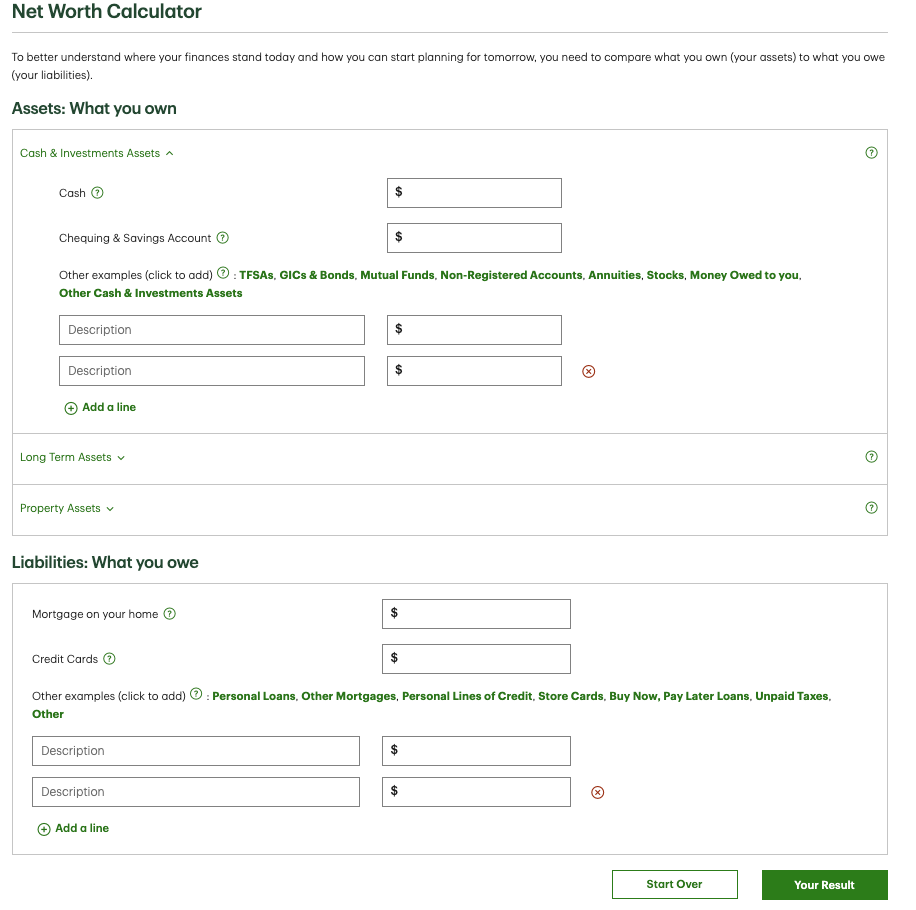

Next, determine your net worth by listing all your assets (home equity, savings, investments) and subtracting liabilities (mortgage, credit card debt). Free tools from Sun Life or TD can streamline this process.

In Burlington, where home values are a significant portion of many residents’ wealth, understanding your home equity—its value minus what you owe on your mortgage—is essential for long-term financial planning and decision-making.

By accurately assessing your financial position, you’ll have a roadmap to confidently manage your homeownership journey.

2. Establishing an Emergency Fund

Every Burlington homeowner needs a reliable financial buffer. An emergency fund, ideally covering three to six months of living expenses, protects you from unexpected costs. Start by opening a high-interest savings account with Canadian institutions like Tangerine or EQ Bank—your money will grow while staying easily accessible.

Why is it essential?

Burlington homeowners face unique challenges, including winter-related emergencies such as furnace breakdowns, burst pipes, or snow damage. These unexpected costs can strain your budget, especially in a city where seasonal weather impacts home maintenance.

How to get started:

- Start small—aim for $1,000 initially, then grow from there.

- Automate monthly transfers to your savings account.

- Reassess the fund annually to ensure it matches your lifestyle and expenses.

Building this fund isn’t just about security; it’s about confidence. With your emergency fund in place, you’ll weather financial surprises without derailing your long-term goals.

3. Managing and Reducing Debt

Effectively managing debt is essential for Burlington homeowners navigating rising living costs and fluctuating interest rates. By tackling high-interest obligations and optimizing mortgage strategies, you can take control of your finances and reduce long-term stress.

Prioritizing High-Interest Debts

Start by addressing high-interest debts like credit cards or personal loans. Options like low-interest balance transfer credit cards or services from local credit unions can consolidate multiple debts into a single, manageable payment. For personalized advice, Burlington homeowners can turn to resources such as Credit Canada or the Burlington office of Consolidated Credit Counseling Services. These organizations provide free or low-cost counseling to create repayment plans that suit your budget.

Understanding Mortgage Management

Mortgages often represent the largest debt for homeowners. Refinancing through Ontario banks like BMO or CIBC can help secure lower interest rates, reducing monthly payments. Take advantage of Canadian mortgage prepayment privileges—many lenders allow up to 15-20% of the principal to be paid annually without penalties. This simple strategy can significantly shorten your amortization period and save you thousands in interest.

For tailored financial solutions, Cruz Financial Group offers comprehensive debt management and mortgage planning services. Whether it’s consolidating debt or optimizing your mortgage, our expertise ensures you’re not just paying off debt but building a secure financial future.

4. Planning for Home Maintenance and Repairs

Proactive planning for home maintenance saves you money in the long run. Burlington homeowners should set aside 1-3% of their home’s value annually to cover routine upkeep and unexpected repairs. For example, on a $750,000 home, aim to budget around $7,500 each year.

Cost-Saving Tips for Seasonal Maintenance

- Winter-proof efficiently: Seal gaps around windows and doors with weatherstripping to lower heating bills and reduce energy waste. Regular furnace tune-ups can also improve efficiency and avoid costly breakdowns.

- DIY when possible: Take on smaller projects like cleaning gutters, painting fences, or maintaining your lawn to save on labor costs.

- Preventative care: Address small issues—like fixing minor leaks or cleaning your HVAC system—before they become expensive problems.

Smart Strategies to Cut Repair Costs

- Plan ahead: Keep a running list of home projects and tackle them during off-seasons when contractor rates are lower.

- Buy materials in bulk: If you’re planning several projects, sourcing materials at once can reduce costs.

- Home warranty plans: Consider investing in a plan that covers major systems and appliances to offset unexpected expenses.

By adopting these strategies, you’ll stay on top of repairs while keeping costs manageable—protecting both your home and your budget.

5. Optimizing Insurance Coverage

Insurance is your financial safety net as a homeowner, but not all policies are created equal. For Burlington homes, comprehensive homeowners insurance is essential to cover risks like water damage or flooding, which can be a concern in certain areas. Whether it’s burst pipes during winter or heavy rainfall, ensuring your policy has sufficient coverage for water-related incidents is a smart move.

How to Choose the Right Home Insurance Coverage

- Compare policies: Use tools like Ratehub.ca or work with local Burlington brokers who understand the area’s unique risks, such as flooding zones near Lake Ontario. Ask for multi-policy discounts if you’re bundling home and auto insurance.

- Customize for Burlington: Investigate additional coverage like overland water insurance, which is becoming increasingly important with changing weather patterns. If you live in an older home, check for exclusions related to aging plumbing or wiring.

- Review annually: After significant events—like renovations that increase your home’s value or adding high-ticket items like solar panels—schedule a policy review. These updates can affect coverage limits or premiums.

- Proactively mitigate risks: Install a sump pump or water alarm to reduce flood risks and qualify for insurance discounts. Insurers may also lower premiums if you install a monitored home security system.

By taking these steps, you can avoid financial setbacks and feel confident knowing your home is well-protected.

Conclusion

Effective financial planning unlocks the rewards of homeownership in Burlington while helping you navigate its unique challenges. By following these financial planning tips for homeowners—from building a robust emergency fund to optimizing insurance coverage—you’ll be ready for the unexpected and protect your most valuable investment.

Ready to take control of your finances and make the most of homeownership in Burlington? Cruz Financial Group offers personalized services, from debt management to mortgage planning, tailored to your unique needs. Visit Cruz Financial Group today and start building a stronger financial future!