In Canada, mortgage rates can feel like a moving target, changing from month to month based on complex economic forces. For anyone in Burlington looking to buy a home or refinance, tracking these rates isn’t just helpful—it’s essential. Mortgage rate fluctuations influence monthly payments, long-term affordability, and even what type of home you can afford in Burlington’s competitive market.

November 2024 brings unique developments in the world of mortgage rates. With the Bank of Canada having raised rates steadily this year to curb inflation, we’re now seeing hints of stability. Experts predict that inflation may be slowing enough for the Bank to hold off on further rate hikes, with the possibility of mortgage rate reductions on the horizon by year-end. These shifts could have a big impact on Burlington homeowners, especially those considering a fixed or variable rate mortgage.

In this article, we’ll dive into Burlington’s current mortgage rate trends, explore what’s driving these changes, and discover tips for securing the best possible mortgage rates in Canada.

Overview of Current Mortgage Rates in Canada

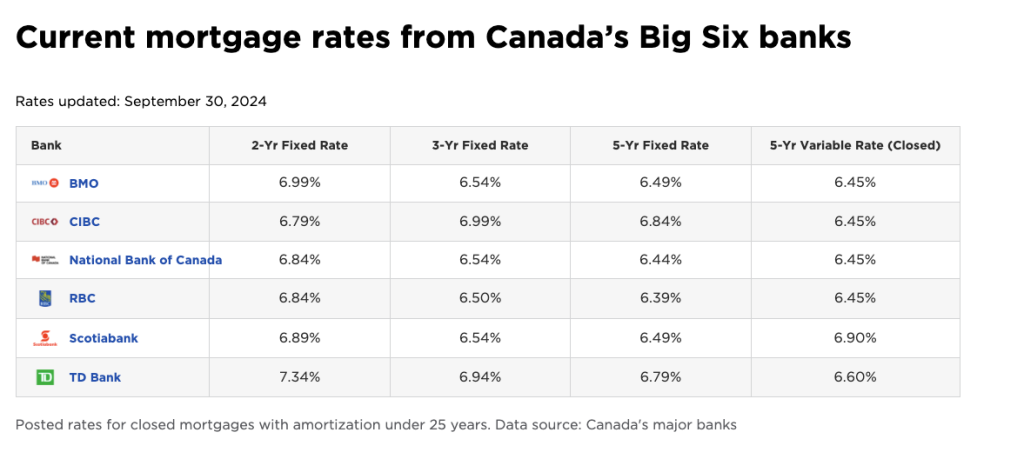

In November 2024, mortgage rates across Canada continued to reflect the country’s response to economic shifts and inflation control, with the Bank of Canada’s recent rate hikes holding sway. Across major Canadian banks, the 5-year fixed rate currently averages around 6.49% to 6.84%, while the 5-year variable rate ranges from 6.45% to 6.90%.

These rates highlight the stability seen in fixed rates compared to the fluctuation typically experienced with variable rates, making the fixed option more popular among cautious homebuyers in places like Burlington.

Mortgage Rates in Burlington: A Closer Look

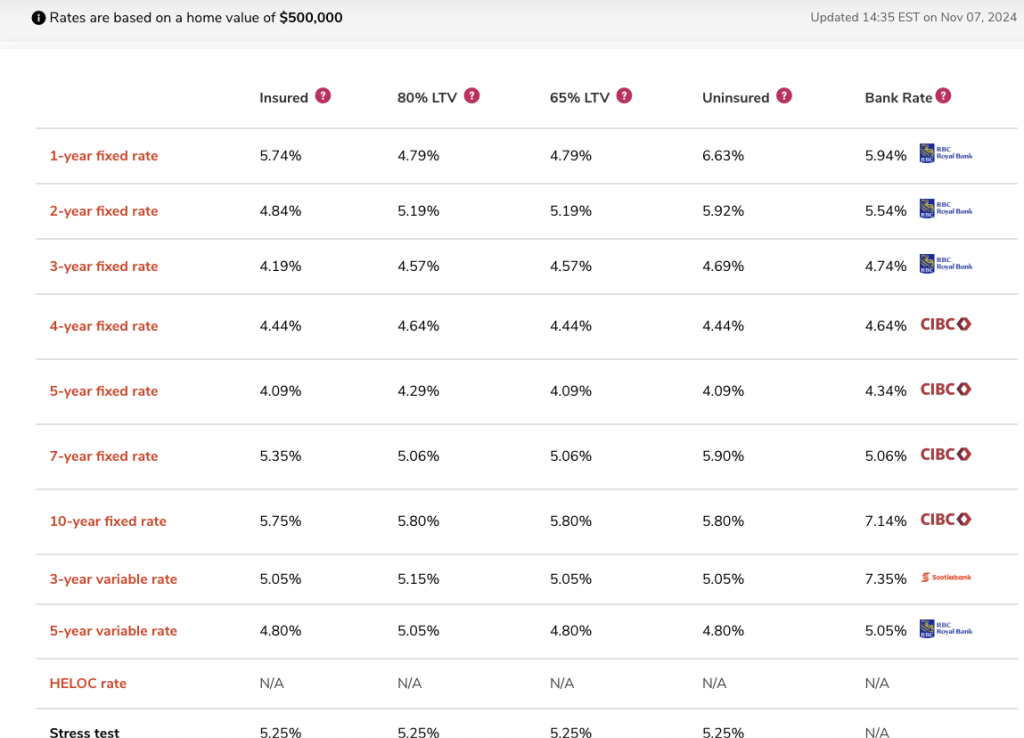

Burlington’s mortgage rates largely mirror the national averages but may differ slightly depending on lender competition in the area and borrower-specific qualifications, such as loan-to-value (LTV) ratios.

For example, RBC Royal Bank offers a 3-year fixed rate of 4.57% with an 80% loan-to-value (LTV) ratio and a 5-year variable rate of 5.05%. These rates serve as helpful benchmarks for Burlington buyers considering various term options and mortgage structures.

Curious whether a fixed or variable rate is better for you? Check out our guide on the pros and cons of each to make the best choice in today’s market.

Key Factors Influencing Mortgage Rates in November 2024

In November 2024, mortgage rates in Canada, including Burlington, are shaped by several economic forces and decisions from the Bank of Canada, with inflation and global conditions playing pivotal roles. Here’s what’s driving mortgage rates this month:

Bank of Canada’s Interest Rate Cut

On October 23, 2024, the Bank of Canada cut its policy rate by 50 basis points, bringing it down to 3.75%. This unexpected rate cut aims to support economic growth as inflation shows signs of stabilizing. The reduced rate has eased some pressure on variable-rate mortgages, giving a potential break to borrowers facing high interest payments.

Impact of Inflation on Mortgage Rates

While inflation has slowed, it remains a factor to watch. The Bank’s rate cut indicates that inflation is nearing acceptable levels, which could open the door to further easing if economic conditions allow. For now, this rate cut may be the start of a gentler interest rate environment, though further cuts will depend on inflation staying under control.

Global Economic Outlook

The uncertain global economy, including factors like international tensions and market volatility, still impacts Canadian mortgage rates. The Bank of Canada may keep rates stable or reduce them cautiously to protect the domestic economy from external pressures.

Local Burlington Market Trends

Burlington’s housing market is also a factor. High demand and limited inventory continue to support elevated home prices, which can add to affordability challenges despite the recent rate cut. For local buyers, the decision between fixed and variable rates remains important given these market dynamics.

Comparing Mortgage Rates in Burlington: Tips for Finding the Best Rate

Securing the best mortgage rates in Canada requires a bit of strategy and some comparison shopping—especially in a competitive market like Burlington. Here are some actionable tips to help you find the lowest possible rate:

- Compare Lenders and Mortgage Products: Different lenders offer different rates and products, so it pays to shop around. Local banks, credit unions, and online lenders often have slightly varied rates, terms, and fees. Don’t settle for the first offer—explore multiple options to ensure you’re getting the best deal.

- Use Rate Aggregators and Comparison Tools: Websites like Ratehub, RateSpy, and LowestRates.ca make it easy to compare mortgage rates in Burlington. These platforms aggregate current rates from various lenders, allowing you to quickly see which lenders are offering competitive rates and terms.

- Boost Your Mortgage Eligibility: Improving your credit score and managing your debt-to-income ratio can help you qualify for lower rates. A strong credit profile signals to lenders that you’re a low-risk borrower, which can result in more favorable rate offers.

- Get Expert Guidance from a Broker: Working with a trusted mortgage broker, like Cruz Financial Group, can help you find the best mortgage deals tailored to your needs. Brokers have access to a wide network of lenders and exclusive rates, saving you time and often securing lower rates than you’d find on your own.

- Negotiate and Time Your Application: Lenders often have some flexibility in their rates, so don’t be afraid to negotiate. Additionally, keep an eye on market conditions and announcements from the Bank of Canada. Applying for a mortgage when rates are stable or declining can also help you lock in a favorable rate.

Conclusion

November 2024’s mortgage rates in Burlington reflect both recent cuts and ongoing stability, making it a strategic time for homebuyers to explore options. To secure the best rate, consider getting pre-approved and staying up-to-date on trends and lender offerings. Taking these steps can help you lock in a rate that fits your financial goals.

Ready to secure the best rate for your home? Connect with the experts at Cruz Financial Group for personalized mortgage guidance tailored to your needs. Get started today and let a trusted advisor help you navigate your options with confidence!