Credit scores can make or break your path to homeownership. These seemingly simple numbers play a massive role in the mortgage approval process, directly affecting whether lenders consider you a reliable borrower. But why do they hold so much power, and how exactly do lenders evaluate them during the home loan process?

Interestingly, while credit scores are vital, many people don’t fully understand them. According to a RATESDOTCA survey, only 57% of Canadians aged 18 to 24 are familiar with their credit score, and while that number improves to 61% for those 65 and older, a significant portion of the population is still in the dark. This lack of awareness can lead to missed opportunities or unfavorable mortgage terms.

In this article, we’ll cover why understanding your credit score is essential before applying for a mortgage, how it impacts your interest rates, and what lenders look for.

What is a Credit Score and How Is It Calculated?

A credit score is a three-digit number that reflects your creditworthiness—essentially, how reliable you are as a borrower. It’s derived from the information in your credit report and helps lenders assess the risk of lending to you. If you manage credit responsibly, your score benefits; if you have difficulty managing credit, it takes a hit. This score changes over time as your credit report updates.

Key Factors Influencing Your Credit Score:

- Payment History: This is the most significant factor, showing whether you’ve paid your past credit obligations on time. Missed or late payments can severely lower your score.

- Credit Utilization: The ratio of your current credit card balances to your credit limits. Keeping this number below 30% is ideal for maintaining a strong score.

- Length of Credit History: The longer your credit accounts have been active, the better. It indicates stability and reliability.

- Credit Mix: Having a variety of credit types, such as credit cards, auto loans, mortgages, can boost your score, as it demonstrates your ability to manage different kinds of credit.

- New Credit: Recent applications or inquiries can impact your score temporarily, as they may signal potential financial strain.

FICO vs. VantageScore: How Are They Different?

FICO and VantageScore both evaluate your credit report but weigh factors differently. FICO scores prioritize payment history and credit utilization, while VantageScore uses trended data to see patterns over time.

Unlike FICO, which needs at least six months of credit history, VantageScore can generate a score with just one month of activity, making it more accessible for those new to credit. Knowing these distinctions helps you understand why your score might vary depending on the model used.

Credit Score Ranges and What They Mean for Mortgage Approval

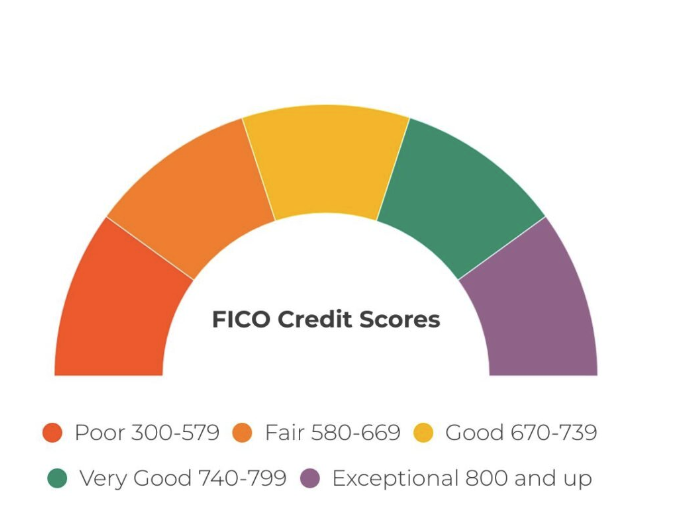

Credit scores typically range from 300 to 900 in Canada, categorized as follows:

- Poor (300-579): High risk, making mortgage approval difficult.

- Fair (580-669): Somewhat risky; potential for approval but at higher interest rates.

- Good (670-739): Considered reliable, likely to secure a mortgage with decent terms.

- Very Good (740-799): Shows strong creditworthiness, making approval easier with better rates.

- Excellent (800 and above): Ideal for lenders; results in the most favorable mortgage terms.

According to financial experts, most lenders prefer a minimum credit score of around 680 for traditional mortgage approval, although requirements can vary. Higher scores not only increase your chances of approval but also lead to more competitive interest rates. Achieving at least a good credit score (670 and up) positions you as a less risky borrower and ensures better mortgage terms.

How Does Your Credit Score Influence Mortgage Rates?

Your credit score greatly affects the mortgage interest rates lenders offer. Higher scores signal lower risk, resulting in lower mortgage rates, while lower scores indicate higher risk and lead to higher interest rates.

For instance, consider a borrower with an 800 credit score who qualifies for a $250,000 mortgage at 3.99% interest, resulting in a monthly payment of about $1,298.

If their score drops to the 660-679 range, their rate could rise to 4.29%, pushing the monthly payment to $1,338—an increase of $40 per month or $480 per year. Over 30 years, this adds up to $14,400 in extra costs.

This highlights how even a modest change in credit score can lead to significant long-term expenses. While it’s wise to improve your score for better rates, be cautious not to delay too long, as mortgage rates can shift and offset potential savings.

How to Improve Your Credit Score Before Applying for a Mortgage

Improving your credit score before applying for a mortgage can make a significant difference in the interest rates and loan terms you receive. Here are practical strategies to help boost your score:

Key Steps to Improve Your Credit Score:

- Pay Down Debt: Lower your outstanding balances to improve your credit utilization rate, ideally keeping it below 30%.

- Make Timely Payments: Consistently paying bills on time is crucial, as payment history is the most significant factor in your credit score.

- Reduce New Credit Applications: Avoid applying for new credit accounts close to your mortgage application date, as hard inquiries can temporarily lower your score.

- Check Your Credit Report for Errors: Request a credit report review from major bureaus and ensure there are no inaccuracies like incorrect balances or accounts you don’t recognize.

- Dispute Errors Promptly: If you find errors, dispute them to have them corrected, as even small inaccuracies can affect your score.

How Long Will Improvements Take?

Positive changes, such as paying down debt or correcting errors, may start reflecting in your score within a few months, but significant improvements can take 3 to 6 months or longer.

Preparing for Mortgage Success with a Strong Credit Profile

A strong credit profile is essential for mortgage success. Your credit score influences the rates and terms lenders offer, impacting your financial future. By focusing on timely payments, managing debt effectively, and checking your credit report for errors, you can improve your score and boost lender confidence. With thoughtful financial preparation, you’ll be better positioned to achieve your homeownership goals with confidence and stability.

Looking to secure the best mortgage terms? Cruz Financial Group specializes in personalized financial guidance to help you navigate the mortgage process confidently. Contact Cruz Financial Group today and take the first step toward your dream home with a strong financial foundation.