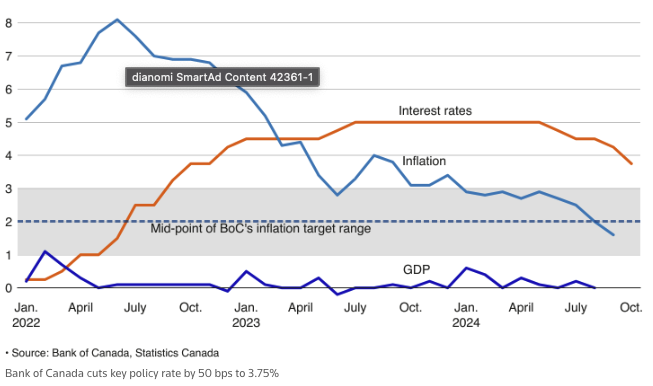

In October 2024, the Bank of Canada made a strategic move, cutting the benchmark interest rate to 3.75%. This decision aims to boost economic growth while managing inflation, but it also has significant implications for the real estate market. Lower interest rates can mean more affordable borrowing, especially for first-time homebuyers eager to enter the market.

For those aspiring to own their first home, this rate cut could be a game-changer, offering better mortgage terms and increased buying power. In this article, you’ll learn how this shift might benefit new buyers and how to make the most of current opportunities.

Understanding the Interest Rate Cut

The Bank of Canada’s recent reduction of the key interest rate to 3.75% was a strategic response to several economic pressures. The decision reflects a focus on encouraging consumer spending and investment amid signs of easing inflation, which dropped to 1.6% in September, below the target of 2%.

Historically, the new 3.75% interest rate cut is relatively low, designed to provide a stimulus while balancing economic stability.

Key Factors Behind the Decision

- Global Economic Trends: Slower growth in advanced economies and cautious forecasts influenced the decision.

- Domestic Economic Slowdown: Indicators like sluggish consumer spending and lower GDP projections signaled the need for support.

- Easing Inflation: Inflation rates fell to 1.6% in September, below the 2% target, allowing room for a rate cut.

- Monitoring Future Data: The Bank remains flexible, hinting at potential further cuts if economic conditions warrant.

This move highlights the Bank’s priority of maintaining balance between growth and inflation control in a still-recovering economy.

Impact on Mortgage Rates

The recent rate cut by the Bank of Canada to 3.75% has a direct impact on mortgage rates, especially for first-time homebuyers. Lower rates help reduce the interest paid on mortgages, car loans, and business loans. According to experts like TD Economist Rishi Sondhi, the cut is expected to ease the financial burden on Canadians, making it less expensive to finance significant purchases like homes, potentially benefiting first-time homebuyers the most.

Comparison of Fixed vs. Variable Rates Post-Cut

- Variable Rates: Homebuyers with variable-rate mortgages are likely to see immediate benefits. Payments will either decrease or more of each payment will go toward the principal, reducing the total interest paid over the life of the mortgage.

- Fixed Rates: The impact on fixed mortgage rates is more muted, as they are tied to government bond yields. Since markets anticipated this rate cut, bond yields already reflect these expectations, limiting drastic changes in fixed rates.

Potential Savings

A 0.5% reduction in interest can save first-time buyers hundreds of dollars monthly on a typical mortgage.

For a $500,000 mortgage at a 25-year term, the recent cut could mean approximately $150–$200 less in monthly payments on a variable-rate mortgage. Lower borrowing costs also increase affordability, potentially allowing first-time buyers to qualify for larger loans.

Improved Affordability for Homebuyers

The recent rate cut has positively impacted the affordability of homes for first-time buyers, enhancing their borrowing power and access to the market.

Increase in Borrowing Power

With the BoC interest rate cut to 3.75%, first-time buyers can qualify for larger mortgage amounts. This means they have greater flexibility in choosing properties, potentially accessing homes that were previously out of reach.

Impact on Down Payment Requirements

Lower rates can reduce the overall mortgage cost, which may allow some buyers to afford smaller down payments while still qualifying for financing. This makes homeownership more attainable without overextending budgets.

Market Entry Opportunities

Industry experts like Phil Soper and Victor Tran highlight that lower borrowing costs may encourage sidelined buyers to enter the market, increasing overall demand. While this can eventually drive up prices, the current rate environment is favorable for those ready to act, providing a unique opportunity to secure homes at more affordable financing rates.

Potential homebuyers should consider the timing, as future rate cuts might lead to increased competition and rising prices, potentially offsetting the benefits of lower rates.

What to Expect in the Real Estate Market

The recent rate cut to 3.75% is expected to lead to notable shifts in the Canadian real estate landscape, with both short- and long-term implications.

Potential Market Shifts

Lower borrowing costs are anticipated to draw more buyers off the sidelines, increasing housing demand. According to Phil Soper of Royal LePage, this could quickly shift the market from sluggish activity to a more competitive environment.

With more buyers entering the market, demand could outpace supply, especially in affordable housing segments.

Inventory Trends and Competition

Experts like Victor Tran suggest that the current market, with ample properties available, may see a surge in listings as sellers respond to renewed buyer interest. However, many buyers may hold off until further rate announcements, leading to a temporary “holding pattern.”

This waiting period could compress buyer interest into short bursts, intensifying competition for affordable homes.

Short- and Long-Term Price Impacts

In the short term, the increased demand could stabilize or slightly drive up prices, particularly if inventory doesn’t keep pace.

Over the long term, if rates continue to fall, the market may heat up rapidly, leading to faster price increases. Leah Zlatkin notes that timing is critical; those who act now might secure better deals before prices potentially rise in a hotter market.

These shifts will require strategic timing from buyers and sellers as they navigate the evolving real estate climate.

Tips for First-Time Homebuyers in a Lower-Rate Environment

In a lower-rate environment, first-time homebuyers have a unique opportunity to secure better mortgage terms and increase their buying power. By taking strategic steps, they can maximize affordability and make the most of the current rate conditions. Here are some practical tips to navigate this landscape effectively.

- Get Pre-Approved Early: Lock in a lower rate while they are available, ensuring you’re ready to make a quick offer if needed.

- Consider Short-Term Fixed Rates: If rates might drop further, a short-term fixed mortgage can offer flexibility.

- Explore Variable Rate Mortgages: With rates lower, variable mortgages may offer more immediate savings.

- Create a Clear Budget: Ensure the mortgage remains affordable even if rates shift in the future.

- Negotiate with Lenders: Leverage the rate cut to find competitive mortgage terms.

- Build a Financial Cushion: Maintain emergency savings to cover potential future rate changes or unexpected expenses.

Conclusion

The recent rate cut to 3.75% offers first-time homebuyers a chance to access more affordable mortgages and increased borrowing power, potentially making homeownership more achievable. It’s a great time to explore your options, but personalized advice can make all the difference.

For tailored mortgage guidance, consider reaching out to experts like Cruz Financial Group to find the best mortgage solution for your needs.